WHITE PAPER

How AI Can Help Address the P&C Insurance Talent Gap

Although hiring new talent is seen as critical to continued growth, insurers say it has become more difficult

Introduction: Insurance industry practitioners come together to discuss challenges in recruiting and retaining talent

The P&C insurance industry grew 1.88% last year, and 73% of insurance companies expect continued revenue growth in 2022¹, yet at the same time the industry’s talent gap is increasing. That’s the message presented at the recent PropertyCasualty360 webinar sponsored by Gradient AI. The webinar featured three industry practitioners: Jeff Rieder, Partner, Head of Ward Benchmarking, Aon, Greg Jamison, Senior VP of Underwriting, MEMIC, and Ken Bunn, VP of Claims, Builders Mutual Insurance.

The webinar, entitled How AI is Transforming the Insurance Industry and Bridging the Talent Gap, presented key industry labor trends and metrics, and the challenges insurers are facing to recruit and retain the talent needed for continued growth. The presenters also discussed how insurers are leveraging AI to bridge this talent gap by capturing institutional knowledge and transferring it to less experienced employees.

Although hiring new talent is seen as critical to continued growth, insurers say it has become more difficult

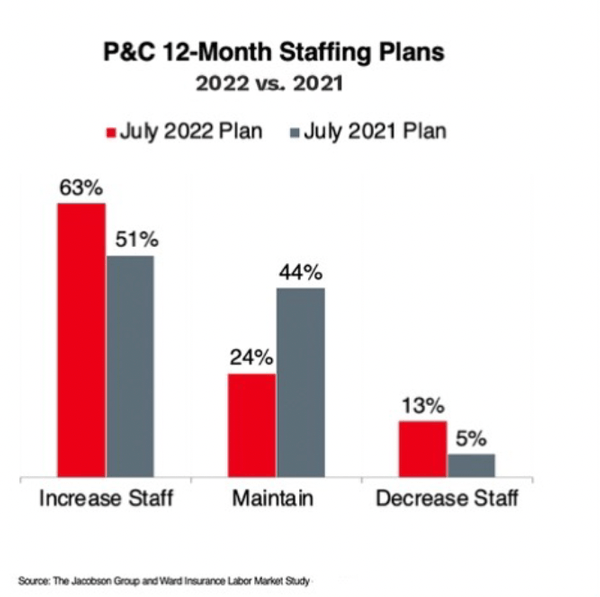

The Jacobson Group and Ward, part of Aon plc, conducted a study to investigate hiring trends within the insurance industry this year. Among the findings of the Q3 Insurance Labor Market Survey², were the following:

- 63% of P&C insurance companies plan to increase staff during the next 12 months.

- Specifically, technology, underwriting, and claims roles are expected to grow the fastest in the next 12 months.

But alarmingly,

- 48% of companies feel the ability to hire talent has become more difficult compared to the prior year.

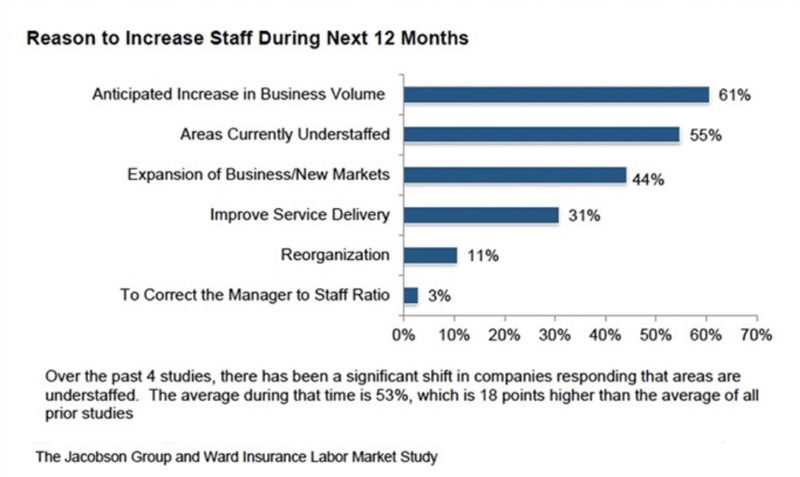

According to the study, the primary reason companies plan to increase staff is an expected increase in business volume, with the secondary reason being that they feel they are currently understaffed. And over the course of the last four studies, there has been a steady increase in the percentage of companies reporting that they are understaffed – indicating a trending problem.

In the webinar, Jeff Rieder said that recruiting difficulties at insurance companies “have reached an all-time high”. He noted that recruiting woes have hit most positions across insurance companies, with the top 5 being technology positions, followed by actuarial, analytics, underwriting, and claims positions.

An aging industry workforce has insurers concerned

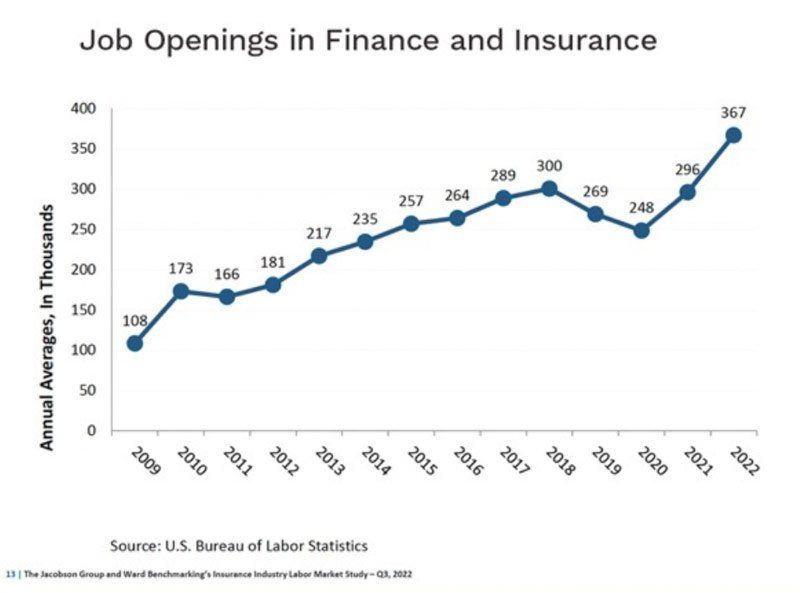

One of the reasons for the worker shortage is the age of the insurance workforce: the median age of insurance company employees is higher than in other financial sectors - meaning they’re more likely to retire soon. According to the U.S. Bureau of Labor Statistics, the number of insurance professionals aged 55 and older has increased 74% in the last ten years, leading to the estimate that over the next 15 years, 50% of the current insurance workforce will retire, leaving more than 400,000 open positions unfilled.³

Additionally, according to the Insurance Information Institute⁴, only 27% of insurance professionals are under the age of 35 – and the industry lags in attracting young people: eight out of ten millennials are unfamiliar with insurance industry career opportunities.

Other challenges to staffing include a limited number of Insurance programs at universities, high turnover rates in entry-level positions, and lack of understanding of opportunities or negative perception of the industry.

When older workers retire, they take years of knowledge and experience with them

One of the primary concerns of industry execs is that as older workers retire, knowledge will be lost – potentially years and years of risk analysis and claims processing experience - and the price tag associated with such losses can be high.

Sometimes, organizations don’t know what they’ve lost until after the expert leaves —and by then, it may be difficult to recover. Harvard Business Review calls this a loss of “deep smarts” and gave the example of one organization whose anticipated wave of 700 retirements would mean the loss of over 27,000 combined years of experience.⁵

Here's where artificial intelligence comes in

There’s no doubt that AI and Machine Learning are having a seismic impact on the insurance industry. In fact, in a 2022 Accenture survey, 80% of insurance executives said that AI technologies can bring more value to their organization, and 65% say they plan to invest more than $10 million into AI in the next three years.⁶

How does AI bring value to a P&C insurance organization? By way of a simple illustration, a new underwriter gets better at predicting the cost of a new policy by seeing more policy applications, evaluating them, pricing them, and then seeing whether the price quoted results in a favorable or unfavorable loss ratio at the end of the policy term. Similarly, a new claims manager gets better at identifying and managing high-cost claims by seeing more new claims, triaging them, managing them, and then seeing whether the ultimate incurred is more or less than the amount of the reserve set. AI leverages this concept of repetitive practice leading to improved performance.

In essence, AI replicates the kind of human learning the underwriter and claims manager can handle, but an AI model can “learn” from far more policies and claims than any person could ever hope to. Where an experienced underwriter might see thousands of applications in a career, an AI model can consider tens of millions of expired policies and the closed claims made against those policies.

Further, the AI model can “remember” every fact in every one of those policies and claims and can compare those facts to every fact in every other policy and claim it has “seen.”

This training process provides the model with the “knowledge” it needs to assess new underwriting applications and claims going forward, providing an insurance organization with powerful capabilities to enhance its traditional operating practices.

Insurers who are leveraging AI are improving loss ratios and profitability by predicting underwriting and claim risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation. When AI is brought into the point of decision – whether in underwriting or claims – that’s where it has a significant impact.

Leveraging AI to bridge the talent gap

In the case of the industry worker shortage discussed in the webinar, insurers are also leveraging AI to bridge the talent gap, capturing institutional knowledge, and transferring it to less experienced employees, and reducing training time. AI allows a transfer of knowledge in a way that hasn’t been seen before.

In the webinar, Ken Bunn explained that at Builders Mutual, “previously, new adjusters would have to sit beside an experienced adjuster for years to observe how they were handling claims. Now, thanks to integrated AI solutions, our newest adjusters can learn quickly and have guardrails in place as they are making decisions. It’s this ability for AI to capture all that experience that could walk out the door and be lost, that delivers an unexpected but compelling strategic benefit to organizations adopting AI. Now, instead, there's an organizational memory of it - it's captured in the model and retained for generations of new adjusters to learn from.”

Conclusion

In addition to the role artificial intelligence can play in solving the talent gap, improved human resource policies are also important.

In the webinar, Jeff Rieder spoke about how forward-thinking organizations are building agility and resilience to recruit and retain top talent by focusing on things like: flexible working (actively shaping where and how their people can work), well-being (adjusting their plans to address physical, emotional, social, financial, and work-related issues), reskilling/upskilling (considering cost optimization, skills requirements, mobility and development initiatives), and diversity and inclusion (also known as DEI -looking at ways to address current and future gaps).

With a growing percentage of insurance industry employees facing retirement in the coming years, issues related to recruiting and retaining top talent to develop the next generation of insurance industry leaders are critical. While these issues are not unique to the insurance industry, they are particularly acute given the demographics of this industry.

By using artificial intelligence combined with smart human resources policies, insurers may be able to help bridge the talent gap in a 1000-year-old industry that is a critical part of the backbone of our modern economy.

Endnotes:

- The Jacobson Group and Ward Benchmarking’s Insurance Industry Labor Market Study – Q3, 2022

- The Jacobson Group and Ward Benchmarking’s Insurance Industry Labor Market Study – Q3, 2022

- U.S. Chamber of Commerce, 2021: The America Works Report: Industry Perspectives

- Insurance Information Institute: Millennial Generation Attitudes About Work and the Insurance Industry

- Harvard Business Review: Succession Planning: What’s Lost When Experts Retire

- Accenture, 2022: Why AI in Insurance Claims and Underwriting?

About Gradient AI

Gradient AI is a leading provider of proven artificial intelligence (AI) solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claim risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation. Unlike other solutions that use a limited claims and underwriting dataset, Gradient's software-as-a-service (SaaS) platform leverages a vast federated dataset comprised of tens of millions of policies and claims. It also incorporates numerous other features including economic, health, geographic, and demographic information. Customers include some of the most recognized insurance carriers, MGAs, TPAs, risk pools, PEOs, and large self-insureds across all major lines of insurance. By using Gradient AI’s solutions, insurers of all types achieve a better return on risk.