Our full-cycle platform improves loss ratios and profitability by predicting underwriting and claim risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation for the insurance industry.

Powering a better return on risk.

Look through the lens of Gradient AI to see a new picture of risk and probability - a picture that grows sharper the more it learns.

Watch this overview of Gradient AI to learn how our proven artificial intelligence solutions for the insurance industry give your most important decisions a distinct advantage.

This is Gradient AI.

Why Gradient AI Underwriting Solutions?

A more complete and in-depth picture of risk providing enhanced underwriting capabilities

decrease in combined loss ratio and expense ratio

increase in Direct Written Premium per Employee

decrease in quote turnaround time

*Actual customer results based on analysis 24 months after implementing Gradient AI

Why Gradient AI Claims Management Solutions?

Gradient improves claims operations

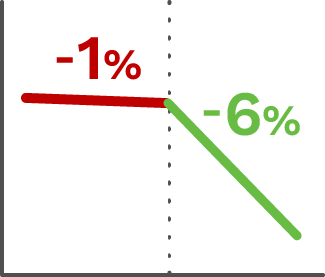

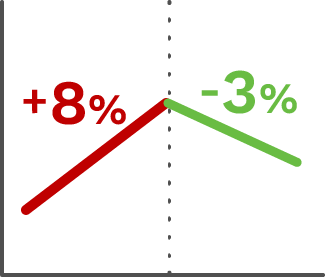

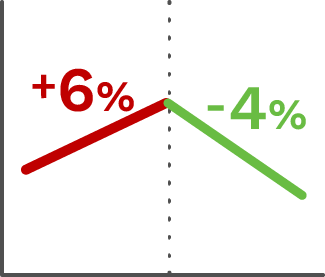

Quarter over quarter trend before and after Gradient AI

Claim Duration

Claim Expense

Claim Cost

Over $300 million in savings realized*

*Actual customer results based on a 6-year independently verified study of 9 quarters before and 9 quarters after implementing Gradient AI

How is AI Used in Insurance?

Where an experienced underwriter might see tens of thousands of applications in a career, an AI insurance model can consider tens of millions of expired policies and the closed claims made against those policies. Further, an AI insurance model can “remember” every fact in every one of those policies and claims and can compare those facts to every fact in every other policy and claim it’s “seen.”

We look forward to hearing about your unique needs.

Book a 30 minute discovery call to get the conversation started.